How to Remove 30-day Late Payments from Your Credit Report

This article will teach you my proprietor 3 step process of how I remove 30-day late payments from credit reports. I’ve perfected this method over the last 20 years as a credit and personal finance advocate while dealing with every possible scenario and just about every creditor out there.

I’ve written this article for people that can’t afford my paid services and want the DIY (Do it yourself) method of removing late s payments from a credit report.

So here is what the process entails if you want to know how to remove late payments from credit report:

Step 1. Discovery of facts (why you were reported late)

Step 2. Identification of errors (what circumstances caused the late payment on your credit report)

Step 3: Engagement with the creditor (strategically arguing and escalating your case)

Step1: Make a thorough discovery of how the late payment occurred

It’s important to see what exactly happened. First, if available, start with looking over the account statements, identify when was the payment due and when was it finally made. Make sure was it a missed payment, or a payment that bounced,. Sometimes the payment could be marked late (normally with a different symbol or code as on-time payments) because the payment made was not enough to cover the minimum amount. You may need to look at your statements or call the creditors to find out the following:

- When payment was due, and what was the amount

- When was the payment finally made

- Was there a bounced payment, or was the payment not enough to cover the minimum payment due

Next, you’ll need to identify what errors or mistakes were made that led to the late payment

Step 2A: Identify any mistakes made by the creditor

Below is a list of common mistakes creditors make that lead to consumers being late on the account. Check if any of these apply to your case, you may need to call the creditor to confirm:

- The creditor applied an annual/monthly fee to your account which led to the late.

- You were locked out of online access to the account or the creditor’s system was down.

- The creditor had the wrong spelling of your address or a missing apartment #.

- The creditor failed to update their system to your new mailing address or email address that you had provided before

- The creditor’s phone rep took down your wrong bank account info when processing your payment.

- The auto payment you had set up was canceled without you knowing.

- There was an interest charge incurred after you thought you had paid off the account in full.

- Charges were made to your card that was not authorized or were of a fraudulent nature.

- You had prior setup a deferment with the creditor due to Covid or a natural disaster and the creditor still marked you late.

- You made a payment on time and the creditor failed to post it to your account.

In the event you do find a mistake as described above, then ask the creditor for a courtesy removal of the late payment, since they’re required to report accurate information to the bureaus. If they agree to remove the mistakenly reported late payment, request a letter stating they are removing the incorrect late payment from the credit report.

Clarify that you want the late payment removed from the credit report and that you are not referring to its corresponding penalty fee (or for example an increase in the interest rate) that may have been incurred.

Normally, if the creditor agrees to remove the late payment they will update the account history on the credit report themselves. Bank of America, American Express, Citibank, and Wells Fargo often update accounts and the credit report within a couple of weeks.

Additionally, I’ve found that credit cards like Capital One, Synchrony Bank, Macy’s Credit (DSNB), Bloomingdales, Comenity Bank, and American Express are more likely to bow to courtesy requests on the phone if you can argue for partial negligence on the creditor’s part.

On the contrary, big banks and credit card companies like Wells Fargo, US Bank, Discover Bank, First Premier, Credit One, Citibank, Prosper marketplace, Green Dot, Moneylion, Elan Financial, and Ally Financial may be swayed to remove a late payment from a credit report.

But it would take some convincing. For auto loan lates, companies like Chrysler Financial, Santander USA, and Hyundai Motor Finance would take some work as well.

Mortgage companies like Newrez Shellpoint, Nationstar Mortgage, Specialized Loan Servicing, United Wholesale Mortgage (UWM), the Money Store, and Loan Depot claim on the phone they don’t remove late from a credit report, but if you push hard enough, you can get them to change their position.

Next watch this video before moving on to the next step:

Step 2B: Identify any extenuating circumstances or errors that led to late payments

If you can prove that a third-party mistake or some extenuating circumstances led to the late payment AND it was not due to your financial inability to pay, then you’re in luck. If you can prove this, you can file a dispute with your credit card issuer and have them cancel the charge.

But beware, creditors will never remove a late payment from a credit report due to financial hardship or job loss.

However, if you can show documented proof of the extenuating circumstances that led to the late payment along with a copy of a bank statement showing a healthy balance of a few thousand dollars, then creditors may agree to remove late payments under the following circumstances:

Examples of Extenuating Circumstances or 3rd party errors:

- You traveled while statements were being sent to your home.

- You were hospitalized or suffering from emotional trauma.

- There was a death or emergency in the family.

- Your bookkeeper or accountant forgot to render payment.

- You had set up automatic payments through your bank, which encountered an error.

- Your email was hacked where you get e-statements, or the creditor’s emails ended up in spam.

- Your paper statements and mail was being stolen.

- You had submitted a double payment the month prior, mistakenly thinking it would cover the next month.

- Your town was subjected to a natural disaster.

If you are able to prove a scenario like the one listed above, you will need to ask for the address, fax, or email of the creditor’s “Credit Bureau Department,” to whom you’ll fax this information for review.

Once they receive your information, will review your case and get back to you within 2-4 weeks with their decision.

But you may say “I’ve already tried this and the creditor has simply stonewalled me. What do I do?”

Move to step 3

Step 3A- Engage the Creditor’s Executive Resolutions Department or Credit Bureau Department:

If your first correspondence or call has not worked, then that means you are likely in for the long haul. The next phase here would be to go up the chain of command.

A) Engaging Executive Resolutions Department:

Macy’s, Barclays, Synchrony, Discover, Bank of America, and Capital One all have executive resolution departments. If they don’t allow you to speak to the Executive Resolutions Department, then mail your complaint to their corporate office by certified mail, with attention to their CEO.

Once you have sent the letter explaining everything, it normally takes around 30 or so to get a response.

B) Lodging a Consumer Financial Protection Bureau Complaint:

At this stage, you can lodge a complaint with the Consumer Financial Protection Bureau (CFPB) against the creditor. If it’s a credit union you’re dealing with then you’ll need to file a complaint with the National Credit Union Association. Or here if it’s an education-related debt.

Now, if the late payment did not occur due to the creditor’s negligence or fault, then the complaint cannot be made under the premise that the creditor acted illegally and violated your rights under the FCRA (Fair Credit Reporting Act). You can instead argue in the complaint that the creditor is acting “unfairly.”

Here is how the complaint works:

Step 1: You lodge your complaint against the credit

Step 2: The CFPB will forward your complaint to the creditor for a response.

Step 3: The creditors usually respond within 15 days.

Step 4: If the creditor does not respond favorably, the CFPB allows you to submit your feedback.

However, if you’re lucky, the creditor responds and states they agree to remove the late payment from your credit report. In this case, they will update your credit report within 30 days.

Now, if your case is not strong enough, it is likely that they deny your request. Unfortunately, creditors often can brush aside such requests and stick to their position.

In my experience, large banks such as Bank of America, American Express, Santander, Citibank, and GM Financial normally don’t budge with regulatory complaints. Legal action is very often required for these creditors. That is why I have devised and utilized Step 3 with tremendous success.

Step 3B – Filing a small claims lawsuit or arbitration case against the creditor

Finally, if the first three steps do not yield results, I often help my clients file a small claims suit. Also depending on the creditor sometimes arbitration is a viable solution as well

Here’s what’s great about this; I have seen many judges rule in a consumer’s favor if they can prove wrongdoing by the creditors.

Research your state’s civil code to see what violations were committed pertaining to credit reporting. Also check for breach of contract, or unfair business practices.

Small claims court also requires consumers to show monetary damages. Proof of monetary damages could include documentation that a consumer was turned down for credit. It could also be that they received unfavorable financing terms due to the specific late payment.

Something to remember when trying to remove remarks from credit reports via legal action…Simply filing a suit will not make the creditor buckle.

The case has to be strong and well-documented. What you may find surprising is, that even in the event the creditor does not show up to court, the judge will still look at the merits of the case and rule accordingly.

I normally recommend hiring an experienced professional or attorney if you are going to go down this path.

This is due to the complexities involved with filing and winning a small claims case to erase your late payment,

I do offer a free consultation to determine if legal action is the right course for you to remove a late payment from a credit report.

Will a credit bureau dispute remove a late payment?

A credit bureau dispute will not remove recent late payments, although there’s a small chance it may remove a very old late payment (4 years old) on a closed account.

A lot of misguided credit repair “experts” encourage consumers to dispute recent lates, claiming you’ll get a deletion “if the creditor does not respond within 30 days.”

In reality, this is one of the biggest mistakes you can make.

Why? Simply put, technology.

Today, all the credit bureaus have modernized their systems and switched to automatic dispute verifications where they correspond with the creditor via their data exchange interface, E-Oscar. (Learn more about what credit bureaus are and how they work)

Hence, unlike in the older days, no phone calls or handwritten communication is exchanged between credit bureaus and creditors.

This interface verifies millions of accounts that are disputed by consumers every month in a matter of minutes.

It does so by simply cross-referencing databases of the major consumer credit bureaus and creditors.

How to dispute old late payments on closed accounts with credit bureaus:

However, credit bureau disputes may work with a minor degree of success for one type of late payment:

A very old late payment on an account that’s been closed for at least 4 years or longer.

Generally, a dispute like this for a very old closed account with lates can yield a 30 % success rate.

They can also be effective for questionable older collection accounts and charge-offs if you utilize the dispute the right strategy.

Can a late payment be removed from a credit report if it was caused by the Covid-19 pandemic & shelter in place orders?

It is possible for a lender to remove a late under the CARES ACT if you had a late payment for the month of February 2020 or after that

The economic fallout from the coronavirus has caused lenders to make exceptions for those who suffered a loss of income or health complications as a result of the pandemic.

If you found yourself in this situation, the first step would be to simply call the creditor and see if they’ll be able to issue a courtesy removal of the late payment. They may ask you to prove your loss of income or health complications.

Some creditors have guidelines that state that late payments can only be removed if you called before you fell behind and asked for a deferment.

Read our article about how to address and remove Covid-19 related late payments.

However, lates incurred prior to February 2020, even when sent as a goodwill letter, will not qualify for goodwill deletion under the Covid-19 pandemic situation. In that case, you’ll likely need professional help.

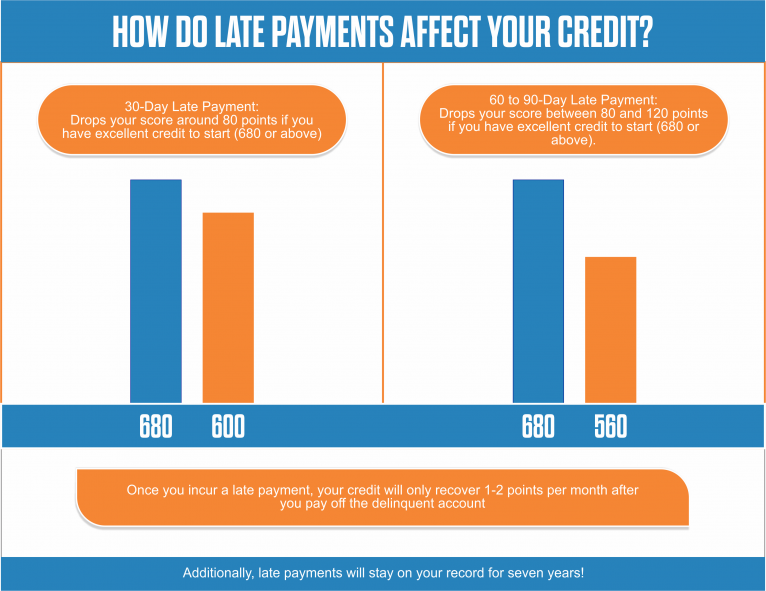

How long does it take for your Fico Score to recover from a late payment?

Although the late payment will stay on your credit report for 7 years, I’ve seen consumers get back about 50% of the lost points in about 2 years’ time, and from then on its a slow progress to get the remaining 50% of the lost points.

To give you details, once you get current on a recent late account, you can expect a 10-15 point increase.

You’ll also see some bumps to the score at the 6-month period and the 18-month period.

Also in addition to these milestones, the score will organically increase by 1-2 points monthly, as long as you keep current on the rest of your credit accounts.

What I always recommend to rebuild your credit score is to avoid additional late payments by trying to send payments several days early to prevent any possible issue.

How does a 30, 60, or 90-day late payment affect your credit score?

If you have good credit scores in the high 600s or over 700, then a recent late will impact you much more than if you had a score lower than 600.

If someone’s never been late before or had no late payments for several years, then a recent late payment can drop their 700 plus Fico credit score by as much as 80 points.

And a 60 to 90-day late would drop the score by 100 to 120 points!

This is regardless of whether it was a $10 payment missed or a $10,000 payment missed, Fico does not differentiate between the two.

What’s most heartbreaking is I’ve seen people with millions of dollars of credit paid on time, and a $2 missed payment ends up destroying their credit score.

Now, on the contrary, consumers with a 550 credit score (who already had multiple other negative accounts), have their score drop by 20-30 pts due to a new late.

Basically, the higher your score is, the bigger drop you’ll experience from a recent late payment.

How long does a late payment stay on your credit report?

The late payment will become part of your credit payment history (or credit history), probably the most significant factor of your FICO score, and stay on your credit report for up to seven years.

That’s up to seven years struggling to get new credit or facing higher interest rates.

The seven years start from the time the late payment was incurred and not from the time the account was started.

Will paying off or closing the account remove the late payment from the credit report?

Unfortunately no, even paying off or closing the credit account will not remove the late payment any sooner. You can call and offer to pay the account, but the so-called ‘pay for deletes’ only works with a paid collection account. I always advise against closing accounts, since that may end up dropping the credit score further.

When does a late payment reported to the credit bureaus?

Here are scenarios of payment due dates and when one could be marked late:

For Payment due date: June 1

If payment is made: June 10th (you will not be marked late, since it is not 30 days past due)

If payment is made: June 29th (you will not be marked late, since its not 30 days past due)

If payment is made: July 1st (you will be marked 30 days late since payment is now exactly 30 days past due)

Will my bank remove my late payment?

So every creditor has different internal policies. As a rule of thumb, you’ll find that with store credit cards you may be able to get deletions on the phone. Whereas mortgage companies require more elbow grease to remove late payments.

Eg. Honda Finance will remove a late payment if you can show proof of medical hardship, whereas Toyota Motor Finance won’t.

Below is a list I’ve compiled using data over the last 20 years of my dealing with creditors, which rate creators from easy to difficult when it comes to removing late payments.

A Creditor that removes late payments (Easy):

- Ally Financial

- Applied Bank

- Bloomingdales

- Capital Bank

- CarMax

- CashCall

- Celtic Bank

- Chrysler Financial

- Credit Acceptance

- Citibank / Citi Card

- Comenity Bank (store cards)

- Credit One

- Discover Bank / Discover Financial

- DSNB (Department Stores National Bank)

- Elan Financial

- First Hawaiian

- First Premier

- Genesis FS Card Services

- Greendot

- GM Financial / Americredit Finance

- Honda Financial / American Honda Finance

- HSBC

- Hyundai Financial / Hyundai Motor America

- Kia Financial

- Kohls

- Macys

- Manufacturers and trader

- Mercedes Benz Financial (MBZ Financial)

- Money Lion

- OneMain Financial

- Oportun

- Regional Acceptance Corp

- Rise Credit

- Specialized Loan Servicing (SPS)

- Santander USA

- Synchrony Bank (store cards)

- Terminix

- Wilshire Consumer

- United Consumer Financial

- US Bank

- Webbank

- Westlake Financial

- Loan depot

Creditors which require effort to remove late payments : ( Medium Difficulty )

- Affirm Inc

- Applied Bank

- American Express

- Barclays

- BBVA

- Caliber Home Loans

- Credit Unions (any one of them)

- Curacao

- BM Harris

- Capital One

- Ford Motor Credit (FMCC)

- Fifth Third Bank

- Flagstar Bank

- Freedom Mortgage

- Goldman Sachs

- Merrick Bank

- Moneylion

- Net Credit

- Nationstar Mr. Cooper

- Nissan Motor Credit

- Newrez (Shellpoint Mortgage)

- PennyMac Mortgage

- Porsche Financial

- PNC Bank

- Southeast Toyota / World Omni Financial

- Toyota/Lexus Financial

- Truist Bank

- Upstart Network

- Upgrade Inc

- USAA

- Wells Fargo Bank

- United Wholesale Mortgage (UWM)

Creditors that rarely remove late payments : (Most Difficult)

(these are creditors we don’t work with):

Audi

BMW Financial

Bank of America (unless it’s a credit card 30-day late within the last 13 months)

Chase credit card

Chase Auto loan

Goldman Sachs

JP Morgan Chase Bank

Lending Club

Student loans

Volkswagen (VW Credit)

TD BANK (unless auto loan )

OTHER CREDITORS NOT MENTIONED ABOVE :

If your creditor is not listed above, reach out to me by email at [email protected] to find out about the difficulty involved in removing the late.

In Conclusion…Things to keep in mind when removing a 30-Day Late Payments

If the above steps don’t work,

Then you may need legal and professional help

Over the last 20 years, I have helped my clients remove hundreds of late payments from their records.

Reach out if you’d like to see if I can help you too!

Click the link below for a consult or for questions email me at [email protected]

240 Comments. Leave new

This is the right website for everyone who really wants to find out about this topic. You know so much its almost hard to argue with you (not that I really will need to…HaHa). You certainly put a brand new spin on a subject that has been written about for years. Great stuff, just wonderful!

My husband recently started building credit and just turned 40. He pays his credit cards each month, mostly in full. Comenity just dropped his credit score 132 points for a $5.96 charge they said was late. He made the payment 7 days late due to us having to get a new bank card because of fraud on the account and having to update the auto withdraw . He paid the payment in full but they did not say anything about the interest needing to be paid that had accrued in that seven days. Online he clicked the “pay in full button”. Not knowing he owed an additional $5.96, this is the payment they sent as late. To me though it was not late if it was something that occurred after the close of his statement balance and would not have been charged until the following month. What is truly confusing is they paid him back as an overpayment, he has a $5.96 credit on his account as if they took his payment and accepted it as if it had been made on time then reimbursed him the interest. It makes no sense and seems to be an error on their end. If he paid in full and was only 7 days late, not 30, and you paid him back that interest as if he had paid on time then there should never have been a late penalty sent to the credit bureau. . We just spoke with them as we started a small business and we are trying to build our credit and credit within the company but this was a huge hit and they refused to fix it. We sent them a hand written letter and they would still not correct this issue . His 100% credit payment history was also knocked down to 98%. What can I do

Hi Javier, if your husband is a victim of fraud , then there are certain protools that need to be followed to declare him a victim of fraud. And after that if the creditor does not correct the issue, then he may be entitled to legal compensation.

Here is an article I’ve written that explains the process for fraud victim https://www.imaxcredit.com/how-to-repair-credit-after-identity-theft-and-fraud/

After reading this feel free to reach out to us for a free consult: https://www.imaxcredit.com/consultation/

Hello Ali, so I’ve had this god awful problem with Newrez/ Shellpoint Mortgage Servicing. My mortgage got taken over by them from my prior lender (fFreedom Mortgage) and the auto pay failed.

I’ve tried to reason with them, I hear you help in taking legal action against them?

Yes David, we’ve dealt with them quite extensively, do shoot me an email at [email protected]

So I have incurred a late with Caliber Home loans for my mortgage.

I’ve called them and also done complaints with the CFPB.

Please let me know if you can help and how long will it take

HI Marco, generally with a Caliber mortgage we can get deletions in about 60 days.

I’ll need to talk to you to see what violations we can leverage on.

I just sent you an email

Hi Ali I’ve got a LoanCare and Cenlar Mortgage late. I sent them all a notice of error letter, as they had put us on deferment and still reported us late. On the phone they all said I was to get paperwork to sign to get the deferment in place, which allegedly was mailed but not received.

I’ve argued this up their chain of command and no one is willing to do a credit corrections . The regulatory agencies has not helped us either. Do I have any recourse against RESPA.

I’m willing to pay for your services to get these removed. Let me know what your success rate is with them.

Hi Joshua, these two lenders are absolutely the worst when it comes to processing deferemnts.

They’re quite the repeat offenders and I’ve dealt with them extensively over the last year.

I’d need to know further details, but safe to assume we’ve got a 80% success rate.

Please email me at [email protected] and we can pick up the conversation there.

Hi Ali,

I got denied a credit card and upon researching it was because of a late payment on my Honda Financial car lease. I am devastated at discovering that that I recall I was only a few just a little over 30 days late but didn’t expected them to report that to credit bureau. This was a innocent oversight as I was abroad tending to extenuating circumstances my family abroad was in. Moreover, I also had covid while being abroad. All that stress made me completely forget that I had a payment. I never ever had a late payment before that. and my record is squeaky clean after as well. How should I proceed with getting this removed?

Thanks,

MS

Hi Mohammad, thanks for reaching out, I just sent you an email.

Hi Ali –

We just got hit with a 30 day late on our mortgage payment. I paid our Freedom Mortgage Payment 14 minutes late. Yes, 14 mins. It was a total oversight. As soon as I realized it, I scrambled and struggled to login, had to reset my password, etc. I figured we’d be ok since it was just past midnight, but I got a credit reporting notice today and this has totally devastated our scores. I did send Freedom a message requesting a goodwill removal of the late, but haven’t heard back yet. This is the first time this has happened with our account. I’m just sick over this. Do you think we have any recourse? Thanks in advance for any insight you can provide.

Sarah, that’s absolutely heartbreaking. Do let me know if Freedom has responded to your goodwill request and what they said. If you don’t have an answer yet, just call them to see where they are on your investigation. Let me know what they say.

So I have a mortgage late with Cenlar Mortgage on my $1.5mil mortgage. I’ve called them millions of times and they can’t remove it. It’s also the only payment I’ve ever been late o. The late was incurred due to the loan servicing being switched over.

please help !

I’ve dealt with Cenlar a few times, and yes through tough but not uncrackable.

Just shoot me an email so we can pick up the conversation,, [email protected]

I missed my payment by mistake and it was 3 days past 30. BofA sent a 30-Day Delinquent to the Credit Agencies. I just called BofA pleaded my case and I explained the situation and ‘used the unreasonable reporting angle” they said they could’t to remove it. What options can I pursue?

Hi Farhan, we should be able to help. I just sent you an email from [email protected]

Hey Ali, hope that you are having a great day. I have a credit card with First Savings. I had paid it off to $0 balance back in Nov of 2021. I have not used it since. Therefore, I have not had any payments since then. Once re-occurring charge I had was a for my annual subscription to AAA. This was charged in May of 2022 and I did not realize it. I, not realizing this, still assumed the balance was $0 so never bothered to make payment for June, as well as for July. I only realized when I received notification from my credit monitoring that it had been reported. This was a $60 original charge plus the late fees equaled just under $100. I totally understand that this was oversight on my part, but I have not had a missed payment in over 12 years. I called the credit card and spoke with customer service, as well as with their manager, and was told they could not remove it from the credit bureau. Do I have any chance in removing this? This was definitely not a situation where I couldnt pay, just didnt realize it had been charged and oversight. Thanks

Hi Bill, sorry to hear about this, the annual suscribtion are quite an issue. One thing you can try is see if AAA can issue a refund to your credit card, and then you can call the card company to see if they’ll remove the late, since there were no charges due. If they don’t agree then reach out to me at [email protected]

Help with late payment

Company: GM financial

Issue: Covid and double pneumonia

in ICU battling for my life and selecting pay by check (processing time was used as payment date instead of the day the payment was actually made.) Not late

I wrote the CEO (several times) and filed a complaint with CFPB

they refused to remove or update the account to show paid as agree

Hi Robert, I can imagine this was an extremely tough and stressful time and GM has been very unfair they way they’ve treated you.

I deal with them quite often, feel free to send me an email at [email protected].

Hello! Bridgecrest is currently holding my credit hostage. I was impacted by COVID and eventually went on STD for a related illness. I communicated regularly and entered in a COVID accommodation loan modification in 11/2020. It brought my account current. They suppressed my credit for 4 months. I became unemployed in 6/2020. Made several payment arrangements, partial payments, etc. They constantly threatened repossession…but I ALWAYS found a way to pay last minute. I borrowed, overdrew my account, etc. I started a new job in 4/2022 and am in a way better financial position than before and bought the car. Every month I have paid more than the scheduled amount. In 6/2022 I entered into a second modification. I paid all the remaining late fees. My account is now 100% current.

I reached out to Bridgecrest about a good will adjustment…you know because I worked hard and did the right thing. They said “we report accurately. We don’t offer adjustments.” I pulled my credit report. They have 19 out of 27 payments reported as late…and 4 suppressed! My on time payment rate is 33%!

I looked up the CARES Act and reached back out. They refused. I submitted CFPB and BBB complaints. Someone from compliance called me and very condescending said “everyone has issues because of COVID” “the flags will fall off in 7 years” and “we have an entire legal team that knows more about CARES Act than you do”. I disputed with all the CRAs. I received a closed dispute in less than 48 hours. I don’t even think they took it seriously.

I looked at the certification they provided Equifax and went line by line and compared to the payment record from their site. I noticed that what they appear to be doing is calculating the days based on the LAST day of the month and payments as of the FIRST day. My due date is on the 13th. So if I for example make a payment on the 12th…they are reporting me 30-59 days late based on the last day of the month and not applying the payment since it was after the first. It was keeping me in a constant 30-59, 60-89 cycle. Last months past due wasn’t even a full scheduled payment so I don’t understand how it was 30+ days late?

I disputed again with a copy of the “certified” reporting and my payment history. I doubt it will make any difference. I am not exactly sure what to do next. Their reporting seems unfair, immoral and borderline unlawful.

I was hoping to purchase a home after the market relaxes a bit. Now, considering the 7 year purgatory compliance kindly pointed out, that will likely not be until my kids are adults.

Hi Misti, this is indeed a re-occuring problem with Covid related CARES ACT late payments. .

I just emailed you from [email protected] to pick up the conversation

Hello,

I was 32 days late on my credit card payment (Minimum payment was $100). It is the only time I have been over 30 days late on the account I have had since 2011. I am currently car shopping and the late payment has tanked my credit. Don’t know what to do. Or what your fee to help is..

Apologies . With Wells Fargo. I spoke with Dispute department with a lady that said she would send a “goodwill letter” internally. She assured me there would be no issue in removing the late payment. Then I received a letter that said there were no inaccuraccies with their reporting. I called the department that said they don’t extend such courtesies and I had been mis-informed….

Hi Ricardo, yes WF’s dispute department is extremely stubborn with consumer. I’d be happy to discussed the options we’ve utilized that have gotten us deletions,

just shot you an email from [email protected]

Hi. I recently received a late payment recorded from a Discover card and . I payed off my account, however there was $6 from deferred interest that I did not know had been added. They paid the $6 with part of $30 in rewards that I has, but still reported it. I have had that card for 10 years or more with zero late payments, and the card is paid in full. I got nowhere with the rep on the phone, and I ended up having to pay a couple thousand dollars to keep a refinance rate during our mortgage refi, bc it hit my score pretty hard in the middle of that process. Any suggestions? I’m pretty annoyed. Thanks!

Hi Elizabeth, we get very frequent deletions from Discover, since my associate attorneys engage their legal dept.

Do email me at [email protected]

Hey ,

I have a 30 day late United Wholesale Mortgage (UWM), I had setup an autopay and they failed to take out my payment. Later on they claimed that auto pay had to be setup 15 days in advance for a payment to process. They are telling me they don’t do adjustments and only report accurate information. I have already reached their CEO’s office but to no avail. Do you have any experience getting removals in situations like this?

Hi Daniel, this is really common with United Wholesale Mortgage and Newrez/Shellpoint as well.

Unfortunately this problem is plaguing a number of people.

We have got a good success rate with UWM, please reach out to me at [email protected]

Hey I read you were successful in removing recent auto loan lates. I have 30 day and 60 day late payments last year from Porsche Financial Services, Mercedes Benz Financial Services, . I was down with Covid at the time and didn’t call in to get a deferment. When I called in to get the lates removed they said I should have called before I was late, I even tried CFPB disputes and got no where. Does any of your strategies work with them?

Lisa, I’m sorry to hear about this, these lenders are very unfair to people who were down with Covid. They normally quote the CARES ACT and state you were supposed to call before you fell behind, which i think is very unreasonable. With Porsche Financial (PFS) and Mercedes Benz Financial (MBZ Financial), we’ve got them to give us deletions recently.

MBZ will often just agree to delete the entire account if they don’t agree to remove just the late.

In any case email me at [email protected] and we can pick up the conversation there.

Hey, I recently had a 30 day late payment on Bank of America account reported to Experian, and Trannsunion last year. I hired Lexington law, Credit Saint and Ovation law, all they did is put in a dispute which came back verified and I wasted my money, Bank of America’s phone reps say they can’t delete. I’ve heard stories from people on Reddit that you can delete with BOA , please let me know if this is true ?

Hi Allen, so sorry to hear about your bad experiences with these other credit repair companies, please lodge a compliant at http://www.consumerfinanance.gov against those companies to get your refund.

As for Bank of America credit card lates, yes we get frequent late payment removals from a specific department at BOA we used over the years.

But it is for specific cases , and below are the requirements:

1. Must be a credit card

2. Late needs to be within last 13 months (cannot be older than that)

If this is the case for your account, do setup a call with me:

https://www.imaxcredit.com/consultation/

Any luck with Toyota Financial? My husband has 2 recent 60 day lates, he is current now, is there any way to get these removed?

Hi Katelyn, we deal with Toyota Motor Credit with 30 and 60 day lates frequently.

Please shoot me an email at [email protected] and we can pick up the conversation.

HI Katelyn, sorry to hear about the late from Toyota Motor Credit Corp (TMCC).

Toyota customer service dept. despite the hardship of the client turns down requests to remove late payments. So the only thing that works with Toyota is legal action

We deal with TMCC frequently and get deletions from their legal department on a monthly basis

Just use the link below to setup a consult with me:

https://www.imaxcredit.com/consultation/

I just had a 30 days late payment with Honda Financial Services on my leased vehicle. It affected a lot my credit score .

Is there a way I can remove it ?

Hi Daniela, with American Honda Finance, they do remove lates, if you have ‘documented” verifiable proof of medical illness at the time of the late.

Aside from that they do make exceptions if there was a “documented” bank error. you can send this info to them for review if available

American Honda Finance doesn’t however make any exceptions for financial hardship.

In any case, if this was just an oversight and there’s no proof of bank error or medical hardship, then we can get involved to help remove

In which case, setup a free consult with me here:

https://www.imaxcredit.com/consultation/

I’ve had a horrendous time with First Premier credit card account that was charged-off account, they basically failed to close my account and kept on charging a monthly fee. I’ve sent them dispute letters and even filed a CFPB complaint to no avail.

What’s the next step ?

Hi Khalid, this is quite unfair but very characteristic of First Premier.

I deal with them quite often.

Please email me directly at [email protected] and we can pick up the conversation there.

Hello, I recently incurred a late payment with my Comenity Ann Taylor account. I didn’t realize my auto pay was not setup correctly and therefore missed a payment of just $12. I have had 100% payment record prior to this. I called the bank and they removed my late payment fee from statements but I don’t think this will fix my credit report. One thing to note is that while I received some phone calls from the bank, they never left a voicemail explaining that I had a late payment, nor did I receive any communication sent to my address by postal Mail. Can this be grounds for getting this late payment removed?

HI Sharmma, with Comenity you often have a good chance to remove if you’re a frontline worker and can provide them proof of that.

If you don’t happen to be a frontline worker, then if you’ve recently moved and have address change proof, that goes a long way.

Otherwise you can setup a consult with me and I can go over more options

Greetings.

I have 30-Day late payments with Bank of America recently. I currently do not have a credit card with BoA but still hold a banking account.

What options do I have.

HI Connie, first thing is call BOA, if that doesn’t work, then writing a goodwill with BOA gets no where.

Specifically, BOA credit bureau dept will make some adjustments if you were travelling or had a medical issue.

If none of these issues apply, then I can help. But only if it’s a credit card account.

you can setup a consult with me here: https://www.imaxcredit.com/consultation/

I had a 30 day late payment to best buy. Due to a refund that sat in their warehouse for 3 weeks before processing. They have lowered my credit score 101 points and also lowered my credit limit. I have filed reports with all agencies and they have all been denied. I had excellent credit and want it removed immediately please Can I have your assistance. I have had this card since 2011 and never been late. Can you guide me where Needs to be next?

Hi Melanie, Citi Bank (for Best Buy) is one of the lenders where we have a high success rate, let’s get on the phone for a free consult for you.

I just sent you an email, if you didn’t receive it , email me at [email protected] or fill out the form below

https://www.imaxcredit.com/consultation/

Hi Ali-

After pulling my credit recently, I found a recent 30-day late mortgage payment from Newrez Shellpoint Mortgage. Looking into, I had gone online to make the payment on Friday Oct 29th, however, because it was in the evening, the payment could not be scheduled until Monday November 1st. I even tried calling the number that night (that historically has always allowed a pay-by-phone instant payment), however, that same number no longer had that instant pay by phone option. Any advice on how I can approach them in a way that maximizes my odds of having them remove the late payment?

Mark Newrez/Shellpoint is absolutely the worst at these types of issues. They never budge to goodwill requests.

We have gotten a few deletions from them, with the help of associate attorneys.

If you like setup a call with me for a consult and I can see if we can help:

https://www.imaxcredit.com/consultation/

Credit One: I had covid last month and missed the annual membership payment, I asked for it to be removed and paid to make account current they told me they can remove it due to there system. Which I know is a lie. I will be calling to speak to credit department today. Is there anything else that I need to do?

Hi Karren, this is very unfair they’ve put this late due to an annual fee.

Most lenders agree to remove if it’s their own annual fee.

Either-way, call and ask for a supervisor.

If that doesn’t get anywhere, you can file a complaint with the CFPB and see what that yeilds.

Finally if that’s unsuccessful , then let me know, I get deletions from their legal dept quite frequently.

Best of luck in the meantime

I recently had a 30 day late with American Express. I paid the day after, so on the 31st day. Have you had any luck getting Amex to budge?

Hi Ann, we’ve absolutely had alot of success with Amex.

First I’d say call customer service , you may have a good shot on the phone if this was a business account, or if you recently changed addresses or forgot to update your billing address. Amex seems to be sympathetic to that situation I’ve found.

In any case, if you don’t succeed, setup a call with me here for a consultation :

https://www.imaxcredit.com/consultation/

So, I have my lease through Santander and incurred a 30 day late for our Chrysler Capital account. They never called and they claim they sent letter in the mail stating that my payment was late. I never got this letter. I did however receive 2 letters. Instead they reported it and lowered my score 139 points with two reports that they made. I have worked hard for 25 years to build my score for nothing. Now I believe there’s nothing I can do to fix it.

Sorry to hear about this issue, this has been a very common practice of Santander.

They’ll often incorrectly claim a letter was sent out about the missed payment.

We deal with them quite frequently, do reach out to me at [email protected] and we can pick up the conversation

Hi Ali, I incurred a 30 day late payment with Macys during the pandemic.

This was not due to financially inability , but I just forgot.

I’ve called and they’ve given me the cold shoulder and even lodged complaints with the CFPB.

My credit is taken a dive and me and my partner can’t get approved for a loan.

What can you do to help ?

Hi Brandon, saddened to hear about this that Macy’s continues to not help folks during Covid.

Macys card is Department Stores National Bank, which is a CitiBank subsidiary.

I’m getting deletions from them as recently as last week, through engaging their legal team .

Shoot me an email at [email protected]

My situation is a little bit different, there was an annual fee charged on my credit card that led to a 30 day late payment. I’ve argued with the card company to remove, since I did not even believe the card was active.

I’ve even filed complaints with the BBB and nothing worked.

I’ve read amazing things about you, I’m hoping you can help

Alex this is quite outrageous that a card company would mark you late for an annual fee, since you didn’t incur a charge.

It’s quite common occurrence that leads folks to unknowingly fall behind.

Depending on who the creditor is I’ve had really high success rates with these, by making a legal argument that you didn’t authorize the fee to be charged to your card.

Creditors like Capital One, Discover, Synchrony, Macys DSNB, Credit One, Capital One, First Premier all have been taken to task over this practice.

Which is the creditor that has reported you ?

Shoot me an email at [email protected] and we can pick up the conversation there.

I have a 30 day late payment from First Premier Bank credit card and it’s hindering me from getting approved for a mortgage. Any chance of getting it removed?

Absolutely John, First Premier is quite the repeat offender.

They rank very low on customer service and often don’t send the requisite notices to clients before late payment insertions.

I just sent you an email from [email protected] , lets pick up the conversation there.

Hello Mr. Zane,

Thank you for this article. I found it quite helpful. Recently myself and my husband incurred a GM Financial lease return related late payment, which turned into a charge-off.

Basically we turned the vehicle in and there was a lease turn in fee, which we were not made aware of, the Fico score has taken a 100pt drop and now we’re unable to refi our home.

What options do we have

Hello Vanessa, so GM finance is quite notorious on marking people late on leases, and they often don’t provide notices for the lease turn in fee and don’t even take it automatically from auto pays.

General Motors Finance leases do have an arbitration clause that can prove to be helpful.

Do email me at [email protected] and we can discuss options.

Good Morning Ali,

I’ve used Lexington Law firm for a year with no luck removing a two 30 day late payment with Capital One Auto Finance on a closed account. Both late payments occurred dec2015 and sept 2017. I’ve sent Good Will letters but after reading you’re information I now know why I’ve have no luck. Is there any way you can help with this?

Hi Antionette, Lexington’s law firm’s disputes unfortunately don’t really work. They recently got sued by the federal govt for defrauding people.

As for Capital One , we may have some options to pursue, do tell me what state do you reside in and what led to the lates?

Email me at [email protected]

I’m in the same situation as Vanessa with GM Financial charging me for a return lease vehicle that I was not aware of and now I have a 30,60,90,120 day past due plus a charge-off. Can you help with this ?

Hi Natilie, General Motors Financial aka Americredit, are doing this to a number of people.

Legally they’re supposed to provide you notice by mail before any late payment insertion with proper itemizations.

They constantly fail to do this.

I’ve had about 10 cases with them just this year alone where we were successful in getting them to delete.

Shoot me an email at [email protected]

Hi, I am buying a home and paid off a lot of debts to a $0 balance, one of the accounts charged a monthly service fee after my account was paid to $0 balance and I was not aware of the new “balance” and they are now reporting a 30 day late to my credit. My score sunk 66 points as a result and i have NO other late payments on my report. I am trying hard to have creditor to remove the derogatory remark as it’s hindering me getting a mortgage. Any suggestions?

Hi Dana, sorry to hear about this, when was the late incurred , who is the creditor ?

We should be able to help , do email me the info at [email protected]

Hi, I found out today that I have missed three payments with Barclaycard and my credit has taken quite a hit because of it. I paid off my entire statement in early March leaving me with a zero balance. I didn’t realize that I was then charged $2.97 interest later in the month, which doubled twice due to late fees. I had automatic payments on for years prior, and only canceled the automatic payment scheduled for March since I had paid the remaining balance already. So my questions are 1) will they remove the negative credit report since it was less than $3.00 and clearly just a miscommunication, and 2) shouldn’t they remove them any since the automatic payments should have kicked in once my balance was no longer zero?

This seems purely punitive at this point and in no way reflects my actual creditworthiness. I have been a client of their’s for several years without incident, and it feels like I am being punished for attempting to pay off the remaining balance.

Hi Mark, this is highly irresponsible of Barclays, and its not the first time they’ve done this.

Shoot me an email at [email protected]

THE SAME THING HAPPENED TO ME . IM SUPPOSED TO CLOSE IN SEPETMBER 2ND THIS IS RUINING MY CREDIT. CAN YOU PLEASE HELP

Janbell, sorry to hear about this, I just shot you an email

Hi

30 day late on my credit in the midst of this corona virus issue. Can you assist?

Hi Matt, if you forgot to pay a bill due to the Convid19 pandemic, then first step would be just to call the lender and see if they’ll remove the late as a courtesy. However, you’ll need to get current on the account, or ask them to put you on a deferment and back date it. If they are not willing to help, then email me at [email protected]

Hi Ali, I’ve got some recent lates on a Synchrony Bank PayPal and amazon cards, I’ve tried everything, including hiring Lexington law firm and using Brandon Weavers disputes, can you help ?

Hi Michael, sorry to hear about nothing working.

Sadly, the credit repair industry is full of individuals making unbacked promises.

As for Synchrony, I’ve got a backdoor channel to their attorneys, normally instead of removing lates, I can get them to remove the entire account.

Shoot me an email at [email protected] and we can talk

I had first premier report some late payments and a charge-off on a couple of accounts. I’m willing to pay them off if they’ll delete

I’ve made CFPB complaints and written to HQ and nothing has worked/

What can I do ?

Hi Richard, sorry to hear about your efforts being stonewalled.

Banks will not remove based on a pay for delete, like collection companies will.

If this late was not due to extraneous circumstances that can be proven,

then we’ll need to get involved.

I’ve had good success with First Premier.

Email me to discuss options [email protected]

So I’ve got a Verizon chargeoff which is about 1 year old.

Basically, what happened is that Verizon is charging me for early cancellation, however there were problems with the service and I was misled by their reps as well.

They’re also claiming equipment was not returned, and that I owe money for my iPhone

At this point Verizon says they won’t remove the charge-off even if I paid them.

This is destroyed my perfect credit and reduced my score by 100 pts.

Have you had any luck with Verizon collections ?

Hi Maurice, this is the same story that I hear from numerous people every month.

Verizon’s account closing polices leave a lot to be desired and are downright unjust.

Fortunately they do respond to heavy handed tactics and escalation with removals.

Please shoot me an email at [email protected]

My first and only 30D late from BMW Financial on September 2019. I only have 4 months left on my 36 month lease. It was a simple mistake on my end. And luck with BMW Financial?

Hi Chris, auto loan servicer like BMW Financial, Audi Financial, Porsche and Toyota are repeat offenders when it comes to missed payments. However, I’ve had some decent luck with them, Just sent you an email

I wanted to find out how to remove late car payments from my credit report.

I recently made a late payment on my GM Financial auto loan

I wanted to know when is a payment 30 days late ? And if you pay on the 30th day is it considered late ?

I have a payment I made on the 30th day which processed one date later.

So would a one day late payment affect the score and if so could I ask for late payment forgiveness ?

Hi Andrew, a payment is 30 days late on the 30th day of the payment not being received. For example if a payment is due on the 1st, then on the 30th it will be considered 30 days late. Then It will end up being being reported to your credit report on the 30th day.

And surely if you are one day late on the payment, it will be reported and will hurt your credit score.

GM Financial is quiet notorious for slapping on late payments on credit reports even if there is a payment processing. However in your case you paid on the 30th day, so they’ll consider that late. So if you’re asking how to remove late car payments from credit reports, a courtesy or goodwill letter will not work.

Use this quiz to see the best course of action for you: https://imaxcredit.com/quiz/

I’ve got a Capital One auto loan which has incurred a 60 day late payment.

Now Will capital one remove late payments?

If not, then please explain how to remove late car payments from credit report.

And if the late can’t be removed how long is the credit score recovery after the late payment ?

Hi Catherine, Capital One late payment forgiveness does not happen often. Unless this was Cap1’s fault or there were some extraneous circumstances that were due to no fault of yours.

Even if you were late by one day, over the 30 day period, Capital One will report to the credit bureau.

I’ve had good success with Cap1 to remove late payments, using legal strategies and getting their attorneys involved.

Do shoot me an email at [email protected]

Hi Ali, I wanted to find out how to remove mortgage late payments?

I have a one late mortgage payment with Bank of America.

I’ve had a mortgage refinance declined due to the late payment as its dropped my score

Hi Tanika, Bank of America is not likely to do a late mortgage payment forgiveness

Yes the late mortgage payment affect on credit score is huge.

Now I’ve seen mortgage late payments removed if there was a fault by the lender and that can be proven

If you can’t find one, then take my quiz to see if you’d be a good candidate to hire a professional for help.

Hi, I am looking for an apartment and have to move immediately due to the death of the homeowner and extenuating circumstances, ie: reverse mortgage. Anyway, my credit score recently went down 100 points showing an innaccuracy for a capital one account for which I was previously listed as an authorized user but was removed prior to the late payments. I called capital one and was told they could not discuss the account with me as I am no longer an authorized user. I affirmed that is correct and I simply wanted them to remove it from my credit report. The representative advised me to dispute it online. I don’t have 30 days to wait for the dispute to complete. Further, I have an account with capital one in good standing. How can I quickly get this resolved and my score updated? Thanks for your help! 🙂

HI Elisha. For authorized user accounts with capital one credit card lates, instead of a goodwill or courtesy removal from capital one, the credit bureaus will remove the accounts with a simple dispute, and even if the authorized user was to call Cap One, the process to remove the 30 or 60 day late payment would have still taken 30 days.

You may call the bureaus and ask for their special teams unit.

For everyone else reading this, the same applies for Barclays card, Bank of America, Chase card, Synchrony, Comenity etc.

l need some help with capital one.

Hi Cristie, just sent you an email, would be glad to help

I had a vacuum financed through Bay Finance LLC (over a year ago). I made 2 payments and then received papers in the mail stating my account had been sent to another finance company (Aqua). I never filled out any of the paperwork for this new finance company and have continued to make my payments to Bay. On my credit report it shows that my payments are on time but my Bay account is closed. The new finance company has an incorrect amount on my current balance, can I dispute this as “no contract” and get it off my report? Am I actually required to repay considering I never agreed to the new contract that they sent?

Hi Wendi, the contracts may state that the debts can be transfered over to a different lender, so this debt would still be considered valid and given its so recent disputes won’t be the way to go

Hello Ali, I’ve a joint mortgage through my credit union. Due to bad timing with my balance, I did not have the full amount available at the time of auto-pay and we’ve been hit with a 30. Since it’s joint, do we contact the creditor separately to make goodwill requests or do I make a sole request since I’m the primary? Also, if the creditor agrees to a goodwill, the late will be removed from my joint partner’s account?

Yes Ark, the late will be removed off both account holders if they agree to remove off one.

So just one request is fine.

If they don’t agree , reach out to me and I may be able to help in getting the matter resolved, using more advanced means.

hi. what about late fees. i was late every month for 1yr at bofa and late fees of 38kept adding up. i could just never catch up but made a pmt every month. they sd they only waive 1fee per year. anything that can be done here.?

Hi Cristina, we may have some options to pursue. They normally don’t do goodwill adjustments , so there can be taken action against them.

Feel free to email me a copy of a report at [email protected], my fees start at $849.

Any luck with BMW financial services late payment?

Hi Theo, they’re very tough to deal with. In California there maybe some options, if you’re out of state, I’ll need to look at the scenario in detail to see what we can do. If you’ve got a report, do fwd it to [email protected]

Hi Ali,

I have a charge-off with Discover. However, at one point fraudulently activity has occurred where someone canceled my card and Discover issued a new one to an out of state address. I wasn’t aware until I called to find out how much was my minimum payment would be and they stated that the card number I provided was cancelled. How can I get this removed from my credit report?

Hi Audrey, we should be able to help, do fwd me a copy of the credit report at [email protected]

Hi Ali ,

This site is super helpful. About to engage with Bank of America, fingers crossed. Have not had one late payment in 10 years and ended up with a one 30-day late payment for an old BOA card that I used to order something online (don’t visit this site often and didn’t realize I had linked my BOA card to it). The balance was roughly $85 and the payment was $25. In any event, I missed this. Pretty sure the due date fell in line with some travel days for work. Going to do my best to get this removed. May reach out to you and your services if I’m unsuccessful. This will be the only blemish on my credit report and I really would like to have it removed, if possible.

Best of luck on this Erin !

Hello,

What is the cost for credit repair? after having very good credit for many years i had a set back. I was divorced, my best friend (Brother) past away, my mother and father got sick, and i guess it took a toll where i had o see a doctor due to depression. I fell behind and became irresponsible and accumulated late payments on my car loan. I had my sister take care of the issue. But she was using the wrong bank account to make the payments and so i got delinquent. There is more to the story, but prefer to consult with you verbally.

Thank You, and hope to hear from you soon.

Marco Valdivia

Hi Marco, depends on when the item fell behind. Do fwd me a copy of your credit report at [email protected] for a free consultation

Any luck with Regions Bank credit card? Made a payment in Jan of last year but apparently it was shy a few dollars and they issued a 30-day late. No luck with front end reps so far.

Hi Heather, we may have some options depending on where you reside. I just sent you an email from [email protected]

Hi Heather, feel free to send me a copy of the report so we can determine what we can do to help

Hello – Regional Acceptance just posted 30 day late after miscommunication of payments and a GAP claim. I tried to make payment while travelling and it looked like their site scheduled. Did not work, paid again 4/01 (Was due 3/27) and it was reported as 30 day late 4/02. Can you help?

Got your email, we should be able to help

Hi Crystal, we should be able to help, feel free to email me a copy of a credit report for a free consultation at [email protected]

Hi Ali,

I had my Target credit card bill being paid through a 3rd party bill payer (PRISM) however in the last couple of months Target repeatedly designated my account as locked (even though I had the right credentials and unlocked it a few times upon request) so my bill never got paid and they marked me 30 days late on my credit report. I’ve had a perfect credit history with them since 2006. When I spoke with them (twice) they said there’s nothing they can do and to call the credit bureaus to dispute.

Hi Guy, Target is pretty notorious for this. I just sent you an email with options we can pursue

Hi Ali! I already sent you an email regarding some Cap1 lates. Please get back to me whenever you can. Thank you!

Sam, I just sent you an email, I don’t seem to have an email from you

Have you had any luck with removing a 30 Day late from GM Financial? I’ve never had any lates on my credit report, and current score is above 800. I just had a baby, and missed the one payment. (My fault). I’m afraid of how much my score is going to be affected, I’ve always been Tier 1 credit. I’ve tried calling and speaking with their credit department, but they say they never remove any lates, unless it’s their error. Have you had any luck with GM?

Hi Dana , just sent you an email regarding this

Good morning Ali,

I have a Premier CC. Due to a complete oversight, after years of no lates, I have a 30 day past due. I’ve paid it as soon as I realized it. I’ve called and requested they remove it since it was just an oversight and they said they can’t. Do you have any suggestions.

Just emailed you Stephen

Hello. Any luck with getting Santander Consumer to remove a 30 day late on car note? It was only 1 day past the 30 days due to the Federal Governement Shut down. They said they do not do goodwill letters and will not help me at all. I had called as well and told them it will be 1 day late and they said that was fine, but there is no record of my call. Any contact information or advice would be greatly appreciated.

Hi Jo Ann, try lodging a complaint with the CFPB against Santander and include proof of the govt shutdown

What can I do if I lost my job and can’t pay my bills ?

Enze once the account is paid off or you’re currently on it, we can come up with options to help.

In the mean time you can look into credit counseling

Hello what can I do to remove a 30 day late payment with Macys ?

Simply see if they’ll remove it as a courtesy on the phone, if they refuse then reach out to me

any luck with Bank of America lates?

absolutely, reach out to me and we can get the ball rolling

Hi Ali,

I have a 30 day late payment with chase ( my mortgage ) I have never been late with any of my creditors in fact I had 100% payment history .I did pay late due to my child being hospitalized in another three hours away . I take full responsibility , but I wanted to ask if you have any suggestions ?

I had a credit score of 840 and now I have dropped by 90 POINTS. I called but I had a rude person who flat out said no she wasn’t forgiving or going to change anything . I made sure I was extremely patient, nice etc .

Thanks

Hi Mirrisa, yes Chase is a tough creditor to deal with, I shot you an email earlier

Hi Mr Zane, I was checking to see if you could possible help with a mortgage late payment from last year?

Hi Lauri, should be able to depending on the creditor , do fill out the contact form and I’ll reach out to you

Hello Ali, I’ve been going back n forth with Santander bank over payments in regards to my heloc over 2 years. I had one payment that was reported late because due to insufficient mailing address. they had everything correct except for the apartment. Because of this my account was locked and closed. I was making payments through the Santander website which takes 3 days to clear. Now i’m paying from my bank online that now takes up to ten days. I have been charges late every month on my credit report. I’ve tried every form of disputing including the CFPB providing proof of payment with no resolution.

Robert, we should be able to help, shoot me an email at [email protected]

I had a payment for my mortgage go 30 days late even though I paid the bill on time it was short $4.00. They increased my payment and I didn’t notice it until 7 days to late. I’m a customer of NBT bank 8 years no late payments in 20 years till now. I’m fico dropped 100 points. Please help.

Hi Ali, just wanted to thank you for putting this out the the web, this helped me repair my credit, you’re an angel !

Thanks Allex, I’m so glad this helped my friend.

Mr Zane, please let me know if you’re taking on new clients for removing lates,

Hi Ben, I will be as of next week, do fill out the contact form below and I’ll reach out to you my friend

Ali, I’ve been dealing with a 30 day late with Amazon/ Synchrony but they’re not budging, can you help professionally ?

Hi Lee, yes lets get to it, I’ve had success with them. Do fill out the contact form below and I’ll reach out to you

HI Ali, I have capital one 30 days late payment in 2015 and 2017 which is hurting my credit score. I went through some credit repair consultants to have it removed but it didnt work out.

Please let me know if you would be able to help me in getting this removed and how much would you charge for this.

Thanks

Hi Babu, I can definitely have a look please email me at [email protected] with the name of the creditors involved or a copy of the credit report.

Awesome stuff, I’ll say this is the most comprehensive plan I’ve seen to remove 30 day lates, I’ll get on it to remove my recent Cap One late

Good going my friend, take action

Ali been following your blog for a while, I’ve grown tremendously through it and now even considering starting my own credit repair company. Would you like to collaborate?

Hi Allex, good to see this has helped you, kudos on deciding to start a new business, although I’m stretched thin and can’t collaborate, I can guide you to the right resources.

Every had luck with VW Credit – I was 1 day after the 30 day cut off – They won’t budge or help – They said they are Black and white and don’t make any exceptions. Any luck with them?

Hi Josh, yes, normally this takes some legal action, but they’re options available to purue

This is terrific information. Thanks so much for sharing.

Appreciate the support Roni !

Hi Ali,

I’ve been trying to get missed payments removed that occurred when I shipped out for military basic training. I used Lexington Law for a few months and they did nothing for me. I’ve worked hard on tying up a few GoodWill letters I was going to send in, and I was wondering if you think this would work or if I could get your opinion on my report?

Hi Austin, sorry about your negative experience with Lexington. Basically, goodwill letters don’t have a high success rate. I just sent you an email with some more details.m

I just got a 30 day late mark on my credit from Target red card. Oversight on my end and I just missed the cut off time for a payment. Have you had success with Target?

Yes indeed Christina, just sent you a link.

I have not had a 30 day late in over 10 years. Recently in an accident and failed to pay Comenity/Eddie Bauer. I have since paid the balance off but they reported a 30 day late as I paid on 10/23 for bill due 9/13.

I called and was told to write a letter. What can I do to get this off. My score went from 752 to 665.

HI Toni, thank for reaching out, just sent you an email with some more info on this

Having a hard time removing a 30 days late from first premier bank card. I sent in goodwills and have yet to hear from them. What should be my next step?

Hi Asino, just sent you an email with some info , looking fwd to helping.

Have you dealt with First Premier Bank Card? I have a 30 day late payment I been trying to remove with a goodwill but I have yet to hear from them.

I contacted wells fargo about a skip payment in nov of 2014 for dec. I stated that I was calling because I didn’t want to hurt my credit but was going through a divorce and could use the extra money for the holidays. The gent stated that they didn’t have a skip payment but what he could do was break up dec payment over the next 6 months. I didn’t find out for a year but they reported me 30 days late 1/15 – 6/15. I have been attempting to get them removed out of good will but they are saying “ethically” they can’t because it’s based off of the original note. I don’t think this is fair as they offered it to me. Had I known I would have just paid the payment. Are their any options?

Hi Kevin, file a complaint with the CFPB against Wells Fargo and someone from their executive dept would pick up the case. If this doesn’t work then we’ll need to look into legal action against Wells.

My dad got a car from CarMart and added my name on it to build my credit. Well it did not really work as he ended up falling behind on the loan. I tried to tell CarMart that I was not the primary but they refused to remove the late. Please help

Hi Christopher, sorry to hear about this. Carmart won’t remove just based on the fact that you were a co-signer on the loan. You’ll need to show why the late occurred and make a case that it was not due to financial inability or willful negligence.

Hi i was good paying customer with wells Fargo for over 72 months and for some reason auto payment didn’t work. I called them and reinstated the auto payment. I contacted Law firm to get rid of 30 day late payment, who asked me to dispute all the three bureaus. I received the letters from all three bureaus stating the 30 day late payment has been verified. I spoke to wells fargo who opened the escalation case again. Please advise what to do, as it is causing a lot of pain and suffering. I am graduating soon and this may impact my ability to acquire apartment and other financial situations.

HI Raj, Wells is notorious for dragging their feet on late payment issues. And yes bureau disputes are absolutely ineffective to remove 30 day lates.

Only way to get this off is if Wells Removes the lates.

However see what happens with the escalation case, however, find out what happened that led to the auto payment being de-activated.

You have to find out who’s at fault here, so call Wells and uncover the facts.

They’ll be more likely to remove it if this was their error instead of an error from your own bank.

If they don’t agree to expunge this , then reach out to me and I’ll be able to help.

hello I have a paypal credit or bill me later account and I forgot my payment and it has been 34 days will I get reported the 30 day late because paypal doesn’t even report if u have an account with them. Thank You!

Hi Mike, it may be on there, I just emailed you with some more info.

hello I forgot my paypal credit or bill me later account payment and it has been 34 days late I was wondering if I will get reported since paypal docent even report if u have a line of credit with. thank you!

Hi Mike, sent you an email with some more info

Thanks so much for the suggestions, I’ve tried everything in the past to address a late with Bank of America, will try your course of action out.

Yes please do so Ben, and let me know what transpires. The bigger banks including BOA are a tougher nut to crack, but best of luck ! If you can’t get anywhere with them then reach out to me

Thanks for these suggestions, I’ve tried these techniques but am still getting pushback from Honda Financial regarding a recent late payment. Any suggestions

Hi Mark , please reach out to me at [email protected] with the story behind the late and I’ll see what I can do to help.

Hi Ali,

What is your success rate with CHASE for late payment removals?

Tried out your method, with a late payment with Synchrony Bank/Amazon card, after a CFPB complaint, they relented and removed the late, thanks for spreading the word !!! I’ll be sure to leave you a great review on yelp too !

Hi Stephen, I’m so excited for you my friend, welcome back to perfect credit 🙂

I’ve been reading your blog for over a year now, and have used it effectively to restore my credit, given I have the time on my hands.

I know there are numerous credit repair companies out there, some good and some not so good, but none I’ve seen that share the work that they do and educate their clients.

Keep on sharing this valuable information !

Hi Simon, that’s terrific to hear, I’ll be posting more articles with guides and tips for credit restoration and Fico score improvement within the next month, stay tuned and thanks for your support !

Hi Ali

Have you had any success with getting Amex to remove a late payment from credit report?

Hi Renee, to answer your question, yes, but I’ll need some more info regarding the details of the account, just sent you an email with some additional questions.

Hi Ali,

Have you ever had to deal with Fifth Third Bank? I have had a mortgage loan with them for almost 9 years now and have never been 30 days late until last month due to a mis-communication on who paid the bill. I called them and asked if they would remove the late report, but they were not very nice about it and told me they could not due to the Fair Credit Reporting Act.

Hi Chris, don’t be disheartened, this is their standard line to consumers to get you off the phone. I’ll shoot you an email here to discuss this in detail.

I wanted to thank you for sharing this and I decided to give this tactic a try to remove a Synchrony late payment. Luckily the agreed to remove after my second call to them, they determined that statements were mailed back to them that never reached me.

Great work Melvin, perseverance pays off my friend, super excited for you !

Hi, do you have any suggestions on how to get Merrick Bank to remove a 30 day late? I had Set up auto pay over the phone but apparently it wasn’t for the minimum amount, creating a one time 30 day late. As soon as I got a late laymen’s letter I called and paid the account down and set up auto pay for a higher amount. I tried reaching out to them by phone but they wouldn’t budge. From what I’ve read they are a tough bank to get lates removed. This is the only thing holding me back from a mortgage because it happens just 5 months ago.

Hi Ashley, but yes they’re not that easy to deal with, had some success with them using some legal options.

I’ll shoot you an email here shortly.

Hi Ali, I had a Capital One account which I hadn’t used for over a year, but it incurred a $39 annual fee and it caused a 60-day late payment while I was on vacation, and now they’re not willing to remove this, even though this was their own charge.

HI Rachel, yup Cap One is the notorious repeat offender here. By far I see the majority of late payment issues occur with Capital One late.

Due to this, I deal with them on almost a daily basis. Give me a ring directly 323-983-8973

I had one 30 day late payment with Comenity back on 2/2017, these can be tough to remove.

Hi Ali I’ve got a federal Student loan lote with Navient, that was supposed to be in forbearance but did not get processed and became 120 days late, in addition although I have 1 loan, they’re reporting 5 different loans , please help or advise

Hi Andrea, for the Fed student loan, google for the Department of Education Ombudsman and lodge a complaint against them, in the complaint you want to be very detailed regarding the chronology and the dates, also include proof you had ample funds to make the missed payment. This should get the higher management at the loan servicer involved. Hope this info helps !

Hi Andrea, thanks for reaching you. So if they’re successful on the phone with the bureaus, it should be about 3 days, if they have to write in instead, it may take from 14-30 days.

Hi there, I hired Lexington law to remove a late payment for my Comenity Bankcard and nothing really happened. So I’m skeptical about if credit repair services can help. Please advise on what you can do different

Hi Kevin, so sorry to hear about this, for Lexington if you do a google search and check out their yelp reviews, you’ll see the majority of folks have similar experiences. They basically send out generic dispute letters which will not remove late payments. The only way to remove them is through an intense negotiation with the creditor and if that doesn’t work, then utilizing the legal option. I’d be more than happy to provide you with a consultation and unlike Lexington, we do not charge until we get the late off.

Ok so my husband and I recently were in escrow to get a mortgage and we forgot to make our Paypal credit card payment and this brought our score down by 100 pts. We have about 45 days to close, wanted to know what options we have that would be quick.