No, here’s why you shouldn’t waste your time with credit bureau disputes.

A lot of misguided credit repair “experts” encourage consumers to dispute recent negative account claiming you’ll get a deletion “if the creditor does not respond within 30 days.”

In reality, this is one of the least effective ways of restoring credit. And it doesn’t require any legal expertise. In other words you don’t need a credit repair company to do a credit bureau disputes. You can do it yourself online.

Here’s why credit bureau disputes have become ineffective over the years.

Today, all the credit bureaus have modernized their systems and switched to automatic dispute verifications where they correspond with the creditor via their data exchange interface, E-Oscar. (Learn more about what credit bureaus are and how they work)

Hence, unlike in the older days, no phone calls or handwritten communication is exchanged between credit bureaus and creditors.

This interface verifies millions of accounts that are disputed by consumers every month in a matter of minutes.

Now a credit bureau dispute may only have a limited chance of working in a where you a disputing an account that was closed several years old that the creditor has no record of

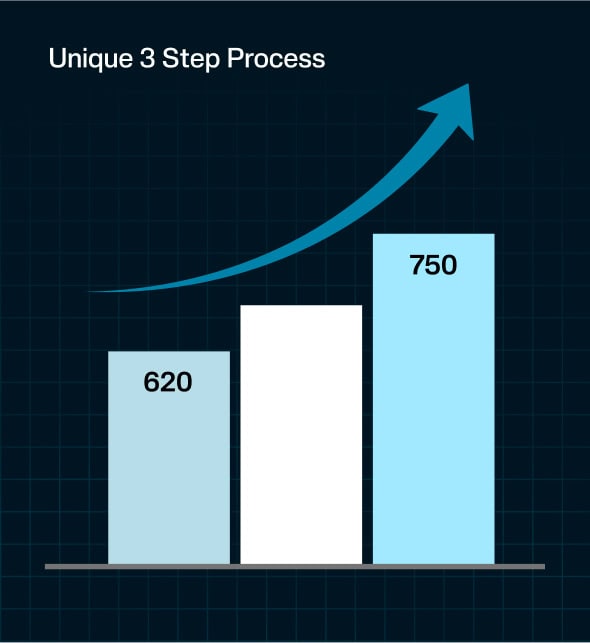

Here at Imax , we use the most effective method of addressing questionable negative items. Instead of generic disputes. our associate attorneys sue creditors to get deletions.