FDCPA: Fight Debt Collection Abuse

Feeling pressured by debt collectors? Don’t be afraid to fight back! This article equips you with knowledge of your debt collection rights. Learn how the Fair Debt Collection Practices Act (FDCPA) protects you from harassment and unfair tactics.

We’ll show you how to navigate debt collection with confidence by stopping harassing phone calls, how you can avoid lawsuits and give you options for settling paid and unpaid debt.

Take charge and reclaim financial control – your future starts now!

1. Empower Yourself and Stop Harassment

Understanding your debt collection rights under the Fair Debt Collection Practices Act (FDCPA) is your secret weapon.

Even though the FDCPA protects you from debt collection harassment practices, aggressive debt collectors may still violate the FDCPA rules and take advantage of your lack of awareness.

Knowing your rights empowers you to level the playing field. Debt collectors aren’t loan sharks, and the FDCPA has strict rules they must follow to ensure fair practices.

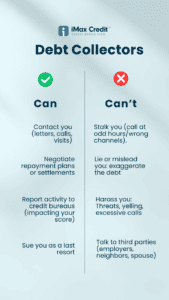

What Debt Collectors Can Do:

- Locating debtors and initiating communication: This can involve sending letters, making phone calls, or even visiting your residence in some cases.

- Negotiating payment plans or settlements: Debt collectors may work with you to establish a manageable repayment plan or discuss a lump sum settlement to resolve the debt.

- Reporting collection activities to credit bureaus: Late payments and debt collection activity can be reported to credit bureaus, potentially impacting your credit score.

- Taking legal action in extreme cases: As a last resort, debt collectors may file a lawsuit to recover the debt, although this typically occurs only after exhausting other options.

Debt collectors use various methods to recover outstanding balances. Imax Credit Repair can help you explore solutions if you’re facing financial hardship.

2. Fight Debt Collector Abuse: Understand Your FDCPA Protections

Are relentless calls from debt collectors causing you stress and anxiety?

Feeling unsure if their tactics are legal?

The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects you from harassment and unfair collection practices.

Here’s a breakdown of key provisions that empower you to have ethical and legal interactions with debt collectors.

- Debt collectors cannot harass or abuse you: This includes using threats, profane language, yelling, or making repeated calls meant to intimidate you.

- They can’t contact third parties: Discussing your debt with anyone other than you, your spouse, or your attorney is prohibited. This includes contacting your employer, neighbours, or friends.

- Make False or Misleading Statements: Debt collectors cannot lie about the amount you owe, claim you’ve committed a crime for not paying, or falsely represent themselves as attorneys or government officials.

- They can only communicate with you during specific times (generally 8:00 AM to 9:00 PM) and can’t use inappropriate channels like email or social media without your written consent.

Knowing these rules is your shield. If a collector breaks them, report them!

Remember: Don’t be afraid to fight back and protect yourself from unethical debt collection practices.

This infographic outlines your FDCPA rights and empowers you to fight back against unfair practices.

3. FDCPA Violations: What to Do If Collectors Cross the Line

The Fair Debt Collection Practices Act (FDCPA) is your shield against aggressive collectors. But what happens if they violate your rights?

The burden of proof lies with you to demonstrate the collector’s FDCPA violation.

Here are 3 important tips to keep in mind:

- Document Everything: Write down dates, times, and details of every conversation.

- Keep a Paper Trail: Keep copies of all letters, emails, or voicemails from the collector.

- A Lawsuit Doesn’t Equal A Violation: Getting sued for debt is a separate legal matter. The FDCPA regulates how collectors interact with you, not lawsuits themselves.

By understanding the FDCPA and how to spot violations, you can protect yourself from unethical debt collection practices.

If debt collectors are not violating the FDCPA rules, there’s another law that may help you fight back against creditors.

4. When Debt Collectors Break the Rules: Taking Action on FDCPA Violations

The FDCPA is a powerful tool, but it’s not your only option.

What if the debt collector seems to be following the rules? Here’s where the Statute of Limitations comes in.

Here’s how the Statute of Limitations can become your secret weapon:

- This law sets a deadline for creditors to sue you for unpaid debts. Once that timeframe (specific to your state and debt type) expires, the debt becomes “time-barred.”

In simpler terms, the creditor loses the legal right to take you to court.

We’ll explore some common statute of limitations timelines in the next section, but remember, these are just examples. It’s crucial to research the specific limitations applicable to your situation.

Why it Matters:

Understanding the Statute of Limitations empowers you in two ways:

- Peace of Mind: Knowing the deadline for lawsuits can ease anxiety about debt collection.

- Potential Defense: If a creditor attempts to sue you outside the statute’s timeframe, you can potentially defend yourself in court.

While we’ll explore common statute of limitations timelines in the next part, it’s crucial to research the specific limitations applicable to your situation.

We’ll also discuss strategies for dealing with “debt vultures” who buy time-barred debts and the impact on your credit report.

5. Navigating Debt Collection: Timelines and Strategies

Knowing the Statute of Limitations timeline for your state is a powerful tool, but it’s just one piece of the puzzle. Here’s what you need to know:

- Researching Your Limitations: In California, the statute of limitations on most debt is four years. This means that a creditor generally has four years from the date of your last payment to sue you for the debt but specifics vary.

- Debt Vultures and Credit Reports: Even if a debt is time-barred, it might still appear on your credit report. We’ll explore strategies for removing time-barred collections.

- Beyond Time Limits: The Statute of Limitations doesn’t eliminate your debt, just the creditor’s legal recourse. We’ll explore options for dealing with both paid and unpaid debts in the next section.

Here are some other examples of common statute of limitations for debt collection in major U.S. cities:

- New York City, New York: Six years for most contracts, including credit cards and medical bills.

- Chicago, Illinois: Five years for written contracts and open accounts.

- Houston, Texas: Four years for written contracts and open accounts.

Check out this helpful chart that breaks down typical timelines for debt collection lawsuits across major U.S. states.

Even if the statute of limitations has expired on your debt, it may still be listed on your credit report.

If you’re looking for ways to remove collections from your credit report, check out our previous article for helpful strategies.

- Beware of Debt Vultures or Junk Debt Buyers: Who specialize in buying these “time-barred” debts at low prices. While they can’t sue you, they might harass you into paying.

The Statute of Limitations can be a powerful tool, but it’s just one piece of the puzzle. With this knowledge in hand, let’s explore options for settling paid and unpaid debts.

6. Settling Both Paid and Unpaid Debt

Considering a debt settlement to move on? You might be surprised to learn how it can apply to both paid and unpaid debts. Here’s how:

- Settling Unpaid Debt: This is the classic scenario. Negotiate a lump sum payment lower than the total owed to clear the debt.

But What About Paid Debt?

Sometimes, errors happen. You might be dealing with:

- Duplicate Payments: You may have already paid the debt but have proof of error.

- Misreported Information: The debt collector might have inaccurate information about your payments.

Don’t Let Mistakes Haunt You!

Understanding debt settlement options empowers you to take control and clear your financial path.

Ready to Take Control of Your Debt?

Now that you know how the Fair Debt Collection Practices Act (FDCPA) works you can identify debt collection practices which are violating your rights.

Remember:

- The FDCPA ensures ethical debt collection practices but the consumer still needs to report them

- The Statute of Limitations may help you avoid a lawsuit depending on your state

- You have options for dealing with both paid and unpaid debts

If you’re facing overwhelming debt and think that you might be getting harrassed give us a call 866 – 611 – 4629.

Trusted Experts Since 2004 with proven results (check out our 5-Star Yelp reviews!). We stay informed on the latest laws and regulations, ensuring you have the most up-to-date guidance.

Don’t wait any longer. Get started on the path to financial well-being today!

Schedule your free consultation today!