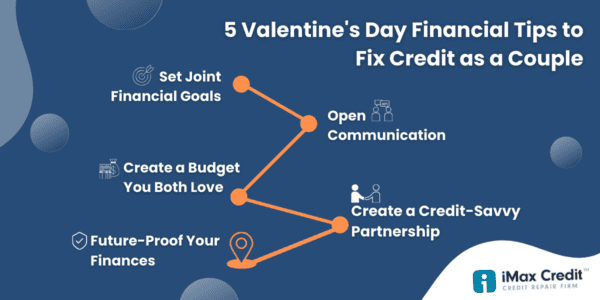

Credit Repair for Couples: 5 Essential Financial Tips

Ditch the chocolates, this Valentine’s Day unlock the secret to financial love! Learn how couples can repair credit together, building a stronger relationship and future.

Whether newlyweds or veterans of love, strengthen your financial future as a team. In this article we will explore actionable strategies for joint goal-setting, open communication about potential challenges, and budget creation. This isn’t just about credit repair, it’s about building a secure foundation for a lasting love story.

You can take our quiz at the end of the article to uncover your “financial love language” score and receive a limited-time discount offer for credit repair services in February.

1. Say Goodbye to your Money Fights and Hello to your Dream Life

Discuss your hopes for the future – do you dream of homeownership? A debt-free honeymoon? Define your shared financial goals and set SMART Goals (Specific, Measurable, Achievable, Relevant, Time-bound), specific timelines and milestones keep you motivated and accountable. These goals will fuel your motivation and guide your financial decisions.

→ Tips:

- Dream Together, Scheme Smarter: Don’t just dream of a house, envision its exact shade of paint. Translate those big dreams into action with SMART goals. 3-bedroom dream by next year? Now that’s a plan!

- Celebrate milestones, and adjust goals as life evolves. Seeing yourselves move towards that dream home (or honeymoon) fuels motivation and strengthens your team spirit.

2. Discover how to Build Financial Transparency with Your Partnership

Revealing private information may be hard especially if you have a low credit score. But it’s always good to start couple financial planning from a place of truth.

- Engage in open discussions about your current credit situation, past mistakes, and spending habits.

- Show empathy and support, understanding that credit challenges typically arise from life circumstances rather than intentional actions. Stress the significance of transparency in your financial relationship.

Remember, this process requires collaboration, and gaining a comprehensive understanding of each other’s financial circumstances is essential.

Here’s a 3 step process to analyze your credit together:

- Obtain Comprehensive Credit Reports: Individually access reports from all three credit bureaus (Equifax, Experian, TransUnion) through AnnualCreditReport.com.

- Joint Analysis: Meticulously examine each report, identifying discrepancies and negative listings. It’s essential to understand What Are The Three Common Credit Report Errors & How to Fix them.

- Dispute inaccurate or false items on your credit reports. Depending on your credit issue read our blog articles provides valuable insights and strategies to address this issue effectively.

Read our blogs Removing 30-day late payments from your credit report as well as how to Remove Charge-Offs From Your Credit Report and Remove Collections from Your Credit Report.

At iMax, our experts offer tailored solutions to analyze your situation, advocate for you, and help you improve your credit score. Sign up for a Free Credit Analysis Today.

3. Learn how to create a Budget You Both Love

Get ready to tackle your finances together! Learn how to track income and expenses as a team, pay off high-interest debt faster, and create a personalized budget using our recommended free apps. It’s all about finding a budget you both can get behind.

→ Tips:

- Collaboratively tracking income and expenses reveals spending patterns and opportunities.

- Combine your incomes to prioritize paying off high-interest debt and focus on newer debts to speed up repayment.

- Craft a personalized budget using the free apps below – even small changes bring big results.

Budgeting Free Apps Recommendations:

- Monefy: Money Tracker: Easily add transactions with a single click for a practical and straightforward budgeting experience. Link

- Money Lover: Expense Tracker: Track expenses, income, debt, bills, and payments conveniently with this comprehensive app. Link

- Wallet: Budget & Money Manager: Automatically track expenses across all your accounts, currencies, and investments for better money management. Link

4. Why Joining Forces on Credit Can Supercharge Your Financial Future

Explore credit-building techniques like secured credit cards and authorized user accounts, coupled with timely payments and vigilant credit monitoring. Consider boosting your partner’s credit by adding them as an authorized user on a responsibly managed card. Caution: shared responsibility for debt applies.

→ Tips:

- Strategic Co-Signing: Once you’ve tackled negative listings and reduced recent debt, strategically co-sign a credit card. Consistently pay off balances in full. Refer to the articles Rules for Co-signing on a Credit Card & Which Credit Card Issuers Allow a Co-Signer?

- Stay updated on changes in your credit reports by utilizing Credit Karma’s free credit monitoring services. This enables prompt detection of errors or fraudulent activities. For more insights consult the articles Credit Monitoring Services: Are They Worth the Cost? & What is credit monitoring and does it protect you from fraud?

5. Future-Proof Your Finances

Prioritize long-term financial stability alongside credit repair by discussing retirement savings, emergency funds, and insurance needs, gradually increasing contributions as your financial situation improves.

→ Tips:

- Craft a detailed budget to outline your monthly income, expenses, and savings goals, allocating funds for essentials like housing, utilities, and groceries, as well as optional spending and savings contributions.

- Diversify Your Income Sources: Explore passive income streams for added stability, especially during uncertain times.

- Stay Informed About Financial Trends: Keep up-to-date on economic and financial trends that may affect your finances, such as interest rate fluctuations, tax law changes, or inflation.

Valentine’s Day isn’t just about love; it’s also a chance to invest in your shared financial future. By trying out these tips, you’ll not only strengthen your financial base and boost your credit score but also add a spark to your love story.

Approaching credit repair as a team effort, backed by love and encouragement, can turn your relationship into a game-changer for your finances. It may take some time and effort, but in the end, your hard work will pay off.