Top 3 Common Credit Report Mistakes and Taking Action

Your credit report plays a crucial role in your financial well-being. It summarizes your credit history, including loans, credit cards, and payment behavior, and is used by lenders to determine your creditworthiness and assign you an interest rate.

Errors in your credit report can have a significant impact, lowering your credit score and hindering your ability to secure loans, rent an apartment, home loans, refinance for a better interest rate or even get a job.

Accurate credit information is crucial for financial well-being. Luckily, the Fair Credit Reporting Act (FCRA) empowers you to ensure this by safeguarding your credit report’s accuracy and allowing you to dispute any errors. Utilize this powerful federal law to guarantee your credit report faithfully reflects your financial health.

In this article and video, alongside consumer rights attorney Shiva Bhaskar, Esq, and credit expert Ali Zane, we’ll guide you through the FCRA’s protections and equip you with effective dispute strategies.

1. The 3 Most Common Violations and Mistakes You can fix on your credit report

One frequent error you might encounter is an account appearing as “charged-off.” This occurs when a creditor considers your debt uncollectible and writes it off their books. While charge-offs are eventually removed from your report after seven years, they can significantly decrease your credit score during that period.

However, there are situations where you may have a legitimate case to remove a charge-off from your report:

- Inaccurate reporting: If the charge-off is for an account you never opened, belongs to someone else (identity theft), or was mistakenly reported, you can dispute it with the credit bureau and the creditor. Learn more in our guide: Remove Charge-Offs From Your Credit Report

- Payment arrangements: If you have made significant payments toward the debt or entered into a repayment plan with the creditor, the charge-off information might need to be updated to reflect your current status.

- Duplicate accounts: The same debt might be listed multiple times, inflating your reported debt and harming your credit score.

→ Things You Might Not Know:

- Credit card rewards: Closing a credit card with a rewards program might lead to inaccurate reporting of the remaining rewards balance as a debt.

- Medical bills: Medical debts can significantly impact your credit score, even if you haven’t received a bill or are actively disputing its validity.

- Student loan defaults: Defaulted student loans can stay on your credit report for up to seven years after the default date, significantly impacting your score.

It’s crucial to review the payment history charts and grids associated with each account on your credit report. Look for any discrepancies in reported payments, such as missing payments you made or incorrect dates.

Some examples:

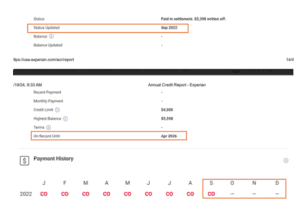

- The account information appears to be outdated. While the charge-off has been settled, the status remains listed as “charge-off” for September 2022 and beyond. For accurate reporting, the account status should be updated to “closed” as of September 2022 (and reflecting the paid status thereafter).

- In the example below, the status says the account was paid in settlement (another notation could be it was settled in full for less than the full balance). However, the balance and recent payment are missing. Any time a charge-off is listed as settled or paid, but those fields are missing, this should be disputed.

We recommend checking out our additional resource, remove charge off, for further guidance on navigating this specific situation and potentially improving your credit score.

2. The Fair Credit Reporting Act (FCRA): Empowering Consumers with Control

The Fair Credit Reporting Act (FCRA), enacted in 1970, is a federal law safeguarding the accuracy, fairness, and privacy of consumer credit information. Understanding your rights under the FCRA is crucial for everyone in the United States, as it empowers you to manage your credit information effectively.

Here’s why the FCRA is important and what it offers:

- Access and Control: You have the right to obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every year. This allows you to monitor your credit for errors and take steps to correct them.

- Dispute Resolution: If you find errors on your credit report, the FCRA gives you the power to dispute them directly with the credit bureau and have them investigated.

- Privacy Protections: You can control who can access your credit report by placing a freeze or lock on it. This helps prevent unauthorized access to your credit information and potential fraud.

- Adverse Action Notification: If your credit report is used to deny you credit, insurance, or employment, you have the right to be notified and receive a copy of the report used in the decision-making process.

By understanding and utilizing your rights under the FCRA, you can maintain control over your credit information and ensure it is accurate and fair, ultimately making informed financial decisions and potentially improving your creditworthiness.

FCRA also regulates:

- Credit bureaus: Ensuring accurate and fair reporting practices.

- Creditors (banks, lenders): Requiring accurate information reporting and responsible handling of negative data.

- Data furnishers (landlords, utilities): Mandating accurate information reporting and investigation of consumer disputes. This ensures the information they provide to credit bureaus, like payment history, is accurate and reflects your true financial standing.

By knowing your FCRA rights, you can maintain control, ensure accuracy, and potentially improve your creditworthiness.

3. Why inaccurate information could be pulling your score down.

The FCRA requires credit bureaus to keep your report accurate and up-to-date. This means information must be verifiable and reflect your true financial activity. Don’t be one of the many who ignore these inaccuracies, as even small errors can significantly lower your credit score and potentially block your ability to secure loans, especially for major purchases like a home.

Top 3 Inaccurate Fields:

Here are the three most common areas where errors might occur:

- Payment history: This includes missed payments, late payments, and any discrepancies in the dates or amounts reported. For example, a well-known case involved Equifax mismatching payment history data between spouses, leading to inaccurate reports for both individuals.

- Account status: This refers to whether an account is open, closed, or in default. A common error involves closed accounts being reported as open, which can negatively impact your credit score.

- Date of last activity: This indicates the last time any activity occurred on an account, including payments or account closure. Inaccurate dates can raise concerns for lenders, potentially leading to loan denials.

Remember, you are your own best advocate when it comes to your credit report. Be proactive and investigate any discrepancies you find.

4. How to correct inaccurate information on your credit report to boost your score

You are entitled to one free credit report per year from each of the three major credit bureaus: Equifax, Experian, and TransUnion. You can request your reports through https://www.annualcreditreport.com/index.action.

Why it’s important to pull all three: Credit bureaus don’t always receive the same information from your creditors and lenders, so your reports may show variations. Pulling all three reports gives you the most complete picture of your credit history and helps you identify any inconsistencies or potential errors that might exist on only one or two of the reports.

Once you receive your reports, carefully review them for any inconsistencies or errors. If you find any, here’s what to do:

- Dispute the error: You can file a dispute online or by mail directly with the credit bureau where you found the error. File online or by mail, clearly outlining the error and including any supporting documentation like payment receipts or creditor correspondence (see our guide: The Most Effective Credit Bureau Dispute Letter).

- Contact the creditor: If the error involves an account you have with a specific creditor, contact them directly and explain the discrepancy. They can investigate the issue and update their records accordingly.

- Consider legal options: If your dispute is denied and you believe the information is demonstrably inaccurate, you may need to consult with a lawyer about further options.

5. Take control of your credit today!

Maintaining an accurate credit report is essential for your financial well-being. Understand the potential errors, know your rights under the FCRA, and proactively address any inaccuracies to protect your credit score and ensure it reflects your financial responsibility. Vigilance and knowledge are your best defense against credit report errors.

Download our free “Credit Report Error Checklist” to quickly identify common mistakes and learn how to dispute them effectively.